Estate Planning Terminology

Ensuring a better understanding

Attorneys often use terminology and acronyms that THEY fully understand, but are confusing and intimidating to their clients. My clients have confirmed that a better understanding makes planning much easier. To help lessen this intimidation factor, I have included a list terms that are common in the estate planning process. This list is certainly not exhaustive nor are the definitions intended to be a complete discusson of any topic. The purpose is to create some degree of familiarity and invite meaningful conversation.

For legal advice, please contact an attorney.

Administrator

An administrator is the term to describe the personal representative appointed by the probate court, when the decedent dies without a Will, to manage the legal affairs of a decedent during the probate process.

Agent

An agent is an individual designated by another person (the “principal”) to make decisions or take action on behalf of the principal. As part of an estate plan, an agent may be appointed pursuant to a Durable Power of Attorney, Medical Power of Attorney, HIPAA Authorization, or Appointment of Agent to Control Disposition of Remains.

Anatomical Gift

An anatomical gift is a donation of all or part of a human body to take effect after the donor’s death for the purpose of transplantation, therapy, research, or education. Texas Health and Safety Code Section 692A.002(B)(3) (Revised Uniform Anatomical Gift Act).

Ancestor

An ancestor is a relative in the direct generational line above an individual (i.e. parents and grandparents). See Descendant.

Attorney in Fact

This is another term to describe an Agent.

Beneficiary

A beneficiary is a person (or charity) for whose benefit property is held in trust or who receive property from a trust.

Bequest

A “bequest” is the act of making a “gift” of property under one’s will. In a legal and historical sense, a bequest involvespersonal property, and a devise applies to real property. These terms are often used interchangeably.

Codicil

A codicil is a document that amends or revokes certain portions of a previously executed will. Codicils are executed in the same manner as wills requiring the testator and witnesses to sign.

Community Property

Texas is one of nine States that are “community property” States. All property acquired DURING a marriage is community property even if titled in the name of only one spouse. A key consideration is estate planning. See also Separate Property. See more detailed discussion under FAQ’s “What is Community Property”

Decedent

A decedent is the person who has died. A decedent’s estate is the property of the person who has died.

Descendant

A descendant is a relative in the direct generational line below an individual (i.e. children, grandchildren, great-grandchildren, etc.). For estate planning purposes, the term will usually include legally adopted children unless designated otherwise. See Ancestor.

Devise

When used as a noun a “devise” means gift of both real and personal property under a Will. When used as a verb “devise” means to dispose of such property. The person who receives the gift is a “devisee”.

Directive to Physicians in Texas a/k/a Living Will

A Directive to Physicians is the term used in Texas for living will. It sets forth an individual’s wishes regarding lifesaving or sustaining procedures in the event he or she has a terminal or irreversible condition. See more detailed under Estate Planning Documents “Directive to Physicians”

Estate

For estate planning purposes estate refers to all of the property owned by an individual at a given time. May include personal property, real property, bank accounts, retirement accounts, investment accounts, life insurance, etc.

Executor

An executor is the term to describe the personal representative appointed under a Will to manage the legal affairs of a decedent during the probate process. Also called a personal representative. If there is no Will, the probate court will appoint a person to act in that capacity but they are then called an “Administrator”.

Fiduciary

A fiduciary is expected to exercise a heightened standard of care when he is acting in the interests of another. This includes a duty of loyalty and a duty to act in the best interests of another (whether it is beneficiaries of a trust, a decedent of an estate or a principal who has appointed him an agent through a power of attorney).

Guardian of the Person – Guardian of the Estate

A Guardian of the Person is an individual who is legally responsible for the care and custody of a minor child (incompetent adult) when the natural parents are unable to do so as the result of death or incapacity. A Guardian of the Estate is an individual or financial institution responsible for the management of property owned by a minor child (or incompetent adult). A guardian may be appointed by a parent in their Will or in a separate document authorized by Texas Probate Code 677A. See more detailed discussion under FAQ’s “How do we select a guardian for our minor children?” and “What happens if we do not appoint a guardian for our minor children?

Grantor (Settlor) (Trustor)

A grantor is a person who creates a trust or contributes property to a trustee of a trust. Sometimes referred to as a settler or trustor, or trust creator.

Heirs at law

Heirs at law are those individuals (including surviving spouse) who inherit the property of an individual dying without a will (intestate). Heirs at law are determined by the intestacy laws of the state where the person lives at the time of death.

HIPAA Authorization

A HIPAA Authorization permits another individual (usually a family member and/or trustee) to access medical records in order to make an educated decision regarding medical treatment and it permits a healthcare provider to share information regarding the medical status of a patient. Without this authorization Privacy Rules prohibit release of this protected information.

Homestead

The term homestead has three different references in Texas. For estate planning purposes homestead refers to the rights of a surviving spouse to occupy the homestead during their remaining life (regardless of who might otherwise inherit the home). For example the decedent’s children might inherit the specific property but the surviving spouse maintains the right to occupy during their lifetime. Texas Constitution Article 16, Section 52. For creditor protection purposes homestead refers that property that is protected from a forced sale by creditors (with exceptions). Texas Constitution Article 16, Section 50. For property tax purposes, homestead refers to a specific tax exemption reduces one’s overall tax burden. In Texas a homestead generally consists of not more than 200 acres (100 if single) for a rural homestead and not more than 10 acres for an urban homestead.

Incapacitated Person

An individual is a legally incapacitated person if (i) they are a minor (under 18), or (ii) an adult who because of a physical or mental condition is unable to care for their own physical health or financial affairs.

Intestacy

Intestacy is the act of dying without a valid will. When an individual dies intestate his or her assets are then distributed to the Heirs at Law through a formal probate process.

Irrevocable Trust

An irrevocable trust is a trust that cannot be amended or revoked. By creating an irrevocable trust, a grantor transferring property to the irrevocable trust effectively gives up all legal rights in that property. Typically, irrevocable trusts are used for the estate, gift, and income tax benefits as well as the protection of assets from creditors. An irrevocable life insurance trust (ILIT) is a very common form of trust that owns a life insurance policy on the life of the grantor. See Documents

Issue

Issue in estate planning typically refers to an individual’s lineal descendants of all degrees (i.e. children, grandchildren, great- grandchildren, etc.). A person who does not have any children is said to have “died without issue”.

Last Will and Testament

See “Will” below. See more detailed discussion and formal requirements under Estate Planning Documents “Last Will and Testament”.

Letters Testamentary

Letters Testamentary are the formal certificate from the probate court clerk stating that the executor named under the decedent’s Will is authorized and qualified to act on behalf of the decedent’s probate estate. Letters of Administration refer to the same certificate for an administrator when the decedent died without a Will.

Life Estate

A life estate is an interest in property only for the duration of a person’s life. For example the right to live in a house for one’s life or to receive the income from property for life, is a “life estate”. After the person’s death the full ownership interest passes to the person or person’s having the remainder interest.

Living (Inter-vivos) Trust

A living trust is a trust created during the grantor’s lifetime. The grantor may also be the trustee. See more detailed discussion under Estate Planning Documents “Revocable Living Trust”. A testamentary trust is created only at the time of an individual’s death, usually in a Will.

Living Will – a/k/a Directive to Physicians in Texas

A living will is a document that sets forth an individual’s wishes regarding lifesaving or sustaining procedures in the event he or she has a terminal or irreversible condition. See more detailed under Estate Planning Documents “Directive to Physicians” See also FAQ’s “What is the difference between a Living Will and a Will?”

Minor

In Texas, a minor is a person under the age of eighteen (18) who has never been married to have not had their “minority” removed for general purposes by a court.

Oral Will (Nuncupative Will)

***** Not Valid In Texas –Of Historical Reference Only *****

Prior to the repeal by Texas Probate Code Section 65 in 2007 an oral Will was valid in Texas for the purpose of disposition of personal property in very restricted situations. The historical basis of an oral will or “deathbed will” was to permit a dying person an emergency method of transferring personal property. Some States may still permit an oral will.

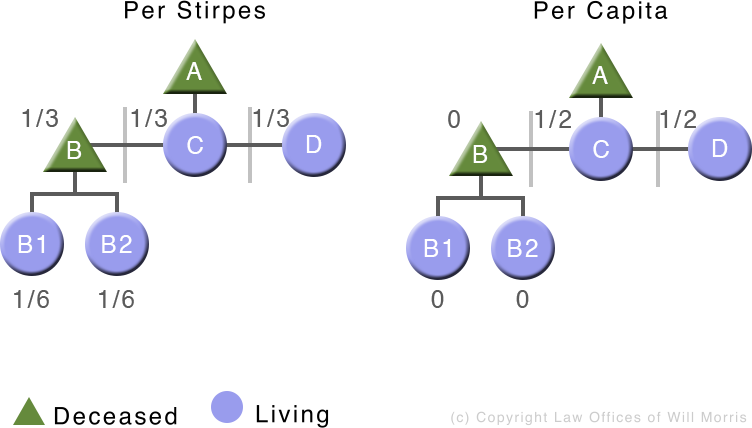

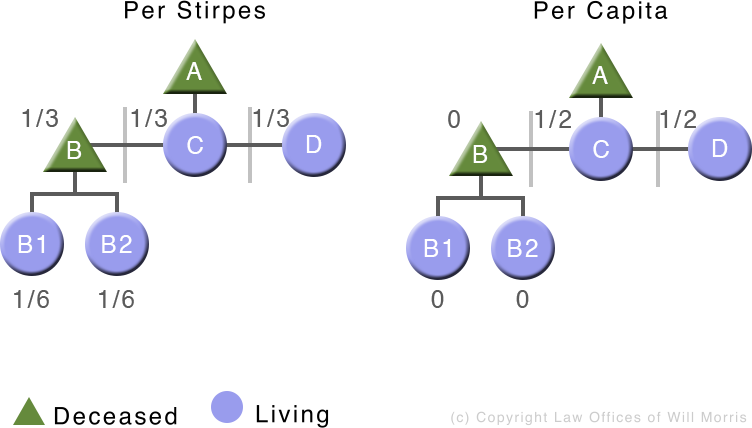

Per Capita

Per Capita distribution refers to the process of distributing a decedent’s property in a manner so that an equal share is created for each generation of heirs THAT ARE LIVING and EXCLUDING descendants of those who are deceased. For example, Jane dies leaving her property to “my descendant’s per capita”. Jane has a total of three (3) children but only 2 are living at the time of Jane’s death. Jane’s property is divided among her two living children and the descendants of the deceased child receive nothing. This is not the preferred method of distribution for most people.

Per Stirpes

Per stirpes distribution refers to the process of distributing a decedent’s property in a manner so that an equal share is created for each member of a generation of heirs, INCLUDING descendants of those who die before the decedent. For example, Jane dies leaving her property to “my descendant’s per stirpes.” Jane has a total of three (3) children but only 2 are living at the time of Jane’s death. If Jane’s deceased child has children then Jane’s property will be divided into three equal shares and the children of the deceased child will divide the one-third (1/3) share designated for their parent, which equals 1/6 per grandchild. This is the preferred method of distribution for most people.

Personal Property

Personal property includes ownership interests in movable property such as goods, furniture, jewelry, money, promissory notes, etc.

Personal Representative

A personal representative is the broad term to include executor, independent executor, administrator, temporary administrator and their successors. term to describe the individual appointed to manage the legal affairs of a decedent. Also called an Executor. A personal representative is appointed in a Will, or if there is no Will, the probate court will appoint the personal representative.

Pet Trust

A trust established for the care and support of a decedent’s pets by naming a custodian and/or providing funds for such support including food, veterinary expenses, and shelter. Texas Property Code Section 112.037 sets out the provisions for a “Trust For Care of Animal”. A pet trust can be the perfect peace of mind solution for the family pet, and expensive show dog, or larger animals such as a horse.

Pour-Over Will

A pour-over will is used by an individual who have already set up a trust or trusts to pass any property to the trust that has not already been transferred to the trust. The assets basically, “pour over” into the trust, thus the terminology. All assets would then be governed, managed and distributed according to the terms of the trust.

Power of Attorney

A power of attorney is broadly described as a written authorization to represent or act on another’s behalf in certain affairs, typically of a medical or financial nature. See more detailed discussion under Estate Planning Documents Durable Power of Attorney, Medical Power of Attorney.

Probate

Probate is the formal process by which a will is proved to be valid or invalid, assets are collected, debts are paid, claims are filed on the estate and any remaining assets are distributed, either based on the terms or a valid will or, if there is no valid will, then according to the state intestacy statute.

Remainder Interest

The remainder interest is the ownership interest in property that vests at the death of another person and the termination of a life estate.

Revocable Trust

A revocable trust is a trust that may be amended or terminated during the life of the settlor. Since the trust may be amended or terminated at any time the assets are considered to still be owned by the settlor. Therefore, it does not reap the tax benefits that an irrevocable trust would. Some main benefits of revocable trusts are:

- flexibility

- ability to retain control of the assets during life

- avoidance of probate

- management of the assets by a trustee

- the ability to provide continuity of management in the event of a disability

Separate Property

Texas is one of nine States that are “community property” States, which also includes the concept of separate property. Generally speaking, separate property is that property owned prior to marriage, by gift, or by inheritance. However, income from separate property may become community property. A key consideration is estate planning. See also Community Property. See more detailed discussion under FAQ’s “What is Community Property”.

Special Needs Trust – Supplemental Needs Trust

A trust established for a disabled beneficiary that permits a supplemental and discretionary distribution of income and principal to preserve the beneficiary’s eligibility for public benefits such as Supplemental Security Income (SSI), Social Security Disability Insurance (SSD), Medicare, Medicaid or other means tested benefits.

Spendthrift Trust

Any trust that contains a provision protecting the trust assets from the beneficiary’s creditors by providing that the beneficiary may not sell, assign, anticipate, encumber, alienate, or otherwise voluntarily transfer the income or principal of the trust, while in the trust, is a spendthrift trust.

Testator

A testator is an individual who dies leaving a valid will. The adjective “testate” means having made a valid will before death. See intestate (dying without a will).

Trust

A trust is a separately created entity which holds property to be managed and distributed according to a specific set of detailed instructions. Trusts come in a number of different forms and can be revocable or irrevocable, but each involves the same three entities. A trust is created by a settlor. It is then managed by a third party trustee per the terms of the trust agreement for the benefit of the beneficiaries.

Trustee

A trustee is an individual or organization (such as a financial institution) that holds or manages property for the benefit of another (the beneficiarie(s)). A trustee has legal obligations to make decisions regarding the trust property which are in the beneficiaries’ best interests and may be liable for damages for not doing so.

Uniform Transfers to Minors Act (UTMA)

A set of uniform laws adopted by many states, including Texas (Texas Trust Code Section 141) that permit a transfer of certain assets to a custodian for the benefit of a minor. Depending upon the nature of the transfer, the custodial account will terminate at either age 18 or age 21. This was formerly known as the Uniform Gift to Minors Act – UGMA.

Will

A Will or (Last Will and Testament) is a legal declaration by which a person (the testator) names one or more persons to manage his/her estate and provides for the transfer of his/her property at death. See more detailed discussion and formal requirements under Estate Planning Documents.